Monday, October 29, 2012

Thursday, October 25, 2012

Model Grand Opening THIS WEEKEND!

This Saturday (October 27th), is the Model Grand Opening at Clover Ridge! Located in Frederick, Maryland, this community is located within miles of shopping, gorgeous parks, and excellent schools. Come explore the beautiful model home and talk to a sales counselor today!

To learn more about Clover Ridge, click [here]

Friday, October 19, 2012

Building Dreams Sale starts TODAY!!

Today is the day! Dan Ryan Builders' Building Dreams Sale begins today and concludes on Sunday evening! Every division is offering amazing upgrades, deals, and incentives to help make your dream of home ownership a reality! Want to know what incentives are offered in each area?? Click the links below for a full list!

West Virginia Panhandle

Frederick, MD area

Morgantown, WV area

Pittsburgh, PA area

Raleigh, NC area

Charleston, SC area

Prince George's County, MD area

Don't forget to visit a Model home to enter to win a $10,000 Dream Furniture Giveaway!!

Wednesday, October 17, 2012

The Best Pumpkin Decorating Ideas!

Fall is the time for baking pumpkin pie, raking the thousands of red and orange leaves in your backyard, and of course, carving pumpkins! Here at Dan Ryan Builders, we know this is an important family tradition, so we wanted to give you some ideas on how to make sure your pumpkin is the envy of everyone on your block!

Hairy Pumpkin

Hairy Pumpkin

Turn your pumpkin on its side. The stem makes a wonderful nose. All you have to do is cut out eyes and a mouth. If the pumpkin is a little too wobbly on its side, cut out some flesh to flatten it. Spaghetti noodles dipped halfway in boiling water for a few seconds make great hair. Stick the uncooked portion into small holes cut in the head.

Message Pumpkin

A picture may be worth 1,000 words, but a few words can have major impact. Carve a message on your pumpkin. Southern Living Associate Garden Editor Rebecca Bull Reed created this work of art and added the wise words “Spooky is what you think you

see.” What do you see?

Start by selecting a theme, such as leaves, ghosts, or spiders. Because pumpkins are pretty tough cookies,

look for durable cutters made of thick stainless steel (www.cookiecutter.com).

Smaller ones work best, as larger designs tend to lose their shape more

easily. Preparing the pumpkins is easy as pie.

Cut a hole in the bottom

instead of the top, and clean out the insides. Place a cookie cutter on

the pumpkin. Gently tap the

cutter with a rubber mallet

until it pushes through the skin. Repeat until you complete your desired

design. Then simply place

each pumpkin over a small

candle, and enjoy the ghoulish glow.

Hairy Pumpkin

Hairy PumpkinTurn your pumpkin on its side. The stem makes a wonderful nose. All you have to do is cut out eyes and a mouth. If the pumpkin is a little too wobbly on its side, cut out some flesh to flatten it. Spaghetti noodles dipped halfway in boiling water for a few seconds make great hair. Stick the uncooked portion into small holes cut in the head.

To see the full list of fun pumpkin carving ideas and easy-to-use templates, click [here]

Monday, October 15, 2012

Tuesday, October 9, 2012

Color Mistakes to Avoid

Planning on sprucing up a room in your house? Here are a few color mistakes to avoid when redoing that special room!

Don't Forget the 60-30-10

Follow the color principal of 60-30-10 to create an aesthetically pleasing color scheme. Divide your color choices into percentages: 60 percent is a dominant color, 30 percent is a secondary color and 10 percent is the accent color.

While beige is a neutral, shades of your favorite

colors can also act as neutrals in your room. A neutral just needs to be

a balance of warm and cool tones, like the shade of red used in this

living room.

Don't be Too Gender Specific

Don't Forget the 60-30-10

Follow the color principal of 60-30-10 to create an aesthetically pleasing color scheme. Divide your color choices into percentages: 60 percent is a dominant color, 30 percent is a secondary color and 10 percent is the accent color.

Don't Ignore Your Lighting

Always consider how lighting will affect your color

choices. Before finalizing your selections, see how each color will look

in the room during different times of the day.

Don't be Too Gender Specific

Pink isn't just for girls and blue for boys any more.

Bring shades that are usually marked for gender specific rooms into the

living areas of your home.

To read the full list, click [here]

Friday, October 5, 2012

Why Buy New??

If

you want a great big kitchen that will become the hub of your family's

daily activities, then a new home will most likely fit the bill. At

Dan Ryan Builders, we offer a variety of floorplans with Kitchen Upgrade

options so you can pick the best layout to fit your needs as well as

use our design center to customize your selections.

WHY BUY NEW?

Kitchens :: The Heart of the Home & One of Your Biggest

Investments.

|

|

Enter our "Dream Furniture Giveaway" at any one of our Model Home Sales Centers NOW October 21st 2012!

*See Sales Manager for Rules and Regulations

Thursday, October 4, 2012

Tips for First Time Home Buyers

You've finally made it. The American Dream. You have been saving for years and are finally ready to buy your own home. So, now what? Still confused on how to navigate the vast and scary housing market? Well, we are here to help! Here is some valuable information for first time home buyers:

Look Beyond Price

When it comes to securing a quality mortgage loan, it is important to look beyond the interest rate to the true cost of the loan, both now and in the future. Read the paperwork, including the fine print, carefully, especially if the interest rate is below market rates. Upon closer inspection you may find that the interest rate is guaranteed for only a short period of time, or that it is subject to rise sharply in the future. Your mortgage loan may be the most important contract you will ever sign, and it is essential that you understand your rights and your responsibilities before signing on the dotted line.

In many cases it will make sense to hire a lawyer to review the mortgage paperwork for you. Many communities provide some sort of first time homebuyer program designed to help renters become homeowners, and these organizations may be able to provide the legal advice you need at a price you can afford.

Every homebuyer will have a different set of circumstances, and it is important for the lender to consider those factors. Some homeowners may plan to move in a year or two, and they may be able to benefit from a variable rate mortgage. Others will plan to remain in their home for decades, and those home buyers may benefit from the stability of a fixed rate mortgage and its predictable and stable monthly payment.

It is also important for those buying a first home to factor in the additional costs of the mortgage when deciding how much they can afford to pay. Things like closing costs and the high price of private mortgage insurance can drive up costs and eat into funds that would otherwise be available for home improvements, furnishings and other essentials. In some cases sellers may be willing to pay some of the closing costs, and some lenders will be able to negotiate those closing costs downward. The key is to ask those questions before the closing date arrives, and to be prepared to search for a better deal if necessary.

First time buyers should also be on the lookout for any hidden fees. These small nuisance fees can add up to hundreds of dollars on closing day, so be sure to scour your paperwork for any such fees. If you are unsure about the legitimacy of any charge be sure to ask for a valid explanation. Again, an experienced real estate attorney can provide valuable insight into which fees are reasonable and which are out of bounds.

To read the full article, click [here]

Look Beyond Price

When it comes to securing a quality mortgage loan, it is important to look beyond the interest rate to the true cost of the loan, both now and in the future. Read the paperwork, including the fine print, carefully, especially if the interest rate is below market rates. Upon closer inspection you may find that the interest rate is guaranteed for only a short period of time, or that it is subject to rise sharply in the future. Your mortgage loan may be the most important contract you will ever sign, and it is essential that you understand your rights and your responsibilities before signing on the dotted line.

In many cases it will make sense to hire a lawyer to review the mortgage paperwork for you. Many communities provide some sort of first time homebuyer program designed to help renters become homeowners, and these organizations may be able to provide the legal advice you need at a price you can afford.

Every Situation is Unique

Every homebuyer will have a different set of circumstances, and it is important for the lender to consider those factors. Some homeowners may plan to move in a year or two, and they may be able to benefit from a variable rate mortgage. Others will plan to remain in their home for decades, and those home buyers may benefit from the stability of a fixed rate mortgage and its predictable and stable monthly payment.

It is also important for those buying a first home to factor in the additional costs of the mortgage when deciding how much they can afford to pay. Things like closing costs and the high price of private mortgage insurance can drive up costs and eat into funds that would otherwise be available for home improvements, furnishings and other essentials. In some cases sellers may be willing to pay some of the closing costs, and some lenders will be able to negotiate those closing costs downward. The key is to ask those questions before the closing date arrives, and to be prepared to search for a better deal if necessary.

First time buyers should also be on the lookout for any hidden fees. These small nuisance fees can add up to hundreds of dollars on closing day, so be sure to scour your paperwork for any such fees. If you are unsure about the legitimacy of any charge be sure to ask for a valid explanation. Again, an experienced real estate attorney can provide valuable insight into which fees are reasonable and which are out of bounds.

To read the full article, click [here]

Monday, October 1, 2012

NOW is the Time To Buy!

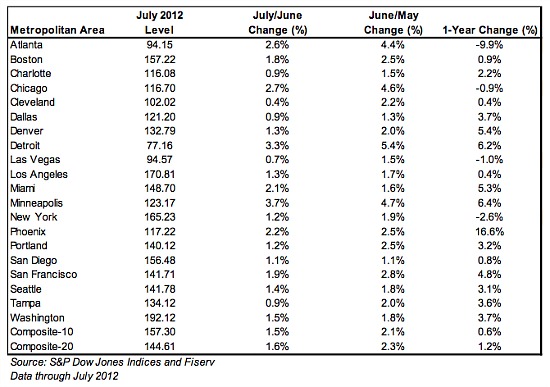

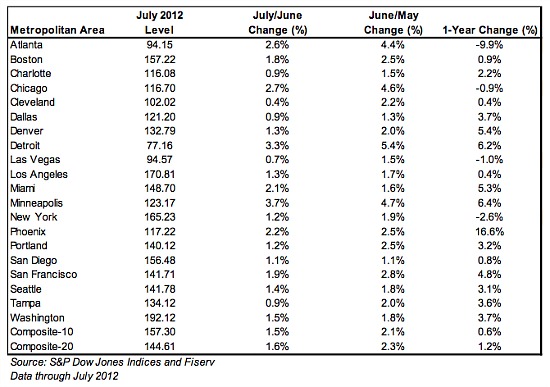

On Tuesday morning, Case-Shiller reported that home prices increased

by 1.2 percent between July 2011 and July 2012 in their 20-city index.

David M. Blitzer, Chairman of the Index Committee at S&P Indices, on the numbers:

“The news on home prices in this report confirm recent good news

about housing. Single family housing starts are well ahead of last

year’s pace, existing home sales are up, the inventory of homes for sale

is down and foreclosure activity is slowing. All in all, we are more

optimistic about housing. Upbeat trends continue. For the third time in a

row, all 20 cities and both Composites had monthly gains. Stronger

housing numbers are a positive factor for other measures including

consumer confidence..”

“The news on home prices in this report confirm recent good news

about housing. Single family housing starts are well ahead of last

year’s pace, existing home sales are up, the inventory of homes for sale

is down and foreclosure activity is slowing. All in all, we are more

optimistic about housing. Upbeat trends continue. For the third time in a

row, all 20 cities and both Composites had monthly gains. Stronger

housing numbers are a positive factor for other measures including

consumer confidence..”

So, what does all of this mean? House prices are steadily going up, and NOW is the time to purchase your dream home.

David M. Blitzer, Chairman of the Index Committee at S&P Indices, on the numbers:

So, what does all of this mean? House prices are steadily going up, and NOW is the time to purchase your dream home.

Subscribe to:

Comments (Atom)